23 октября 2024

USDCAD uptrend strengthens amid Bank of Canada rate cuts

The USDCAD is consolidating near the 2.5 month high. Traders are focusing on today’s interest rate decision from the Bank of Canada. Market expectations point to a possible 50 basis point rate cut.

The decision could be the third consecutive rate cut by the Canadian regulator and the first of such magnitude, driven by easing inflationary pressures, slowing employment growth and consumer spending. Inflation fell to 1.6% in September. This is the lowest level in three years.

The US dollar is strengthening amid rising American Treasury yields. The Dollar Index is nearing a two-month high of 104.20.

On the US economic calendar, secondary housing sales data for September will be released. The Federal Reserve (Fed) will issue a report on the current economic situation in the country in its Beige Book.

Meanwhile, the strength of the US economy and fears of inflation picking up have reduced the chances of a significant Fed rate cut in November. According to the CME FedWatch tool, there is a 91% chance of a 25 basis point cut, while a larger 50 basis point cut is unlikely.

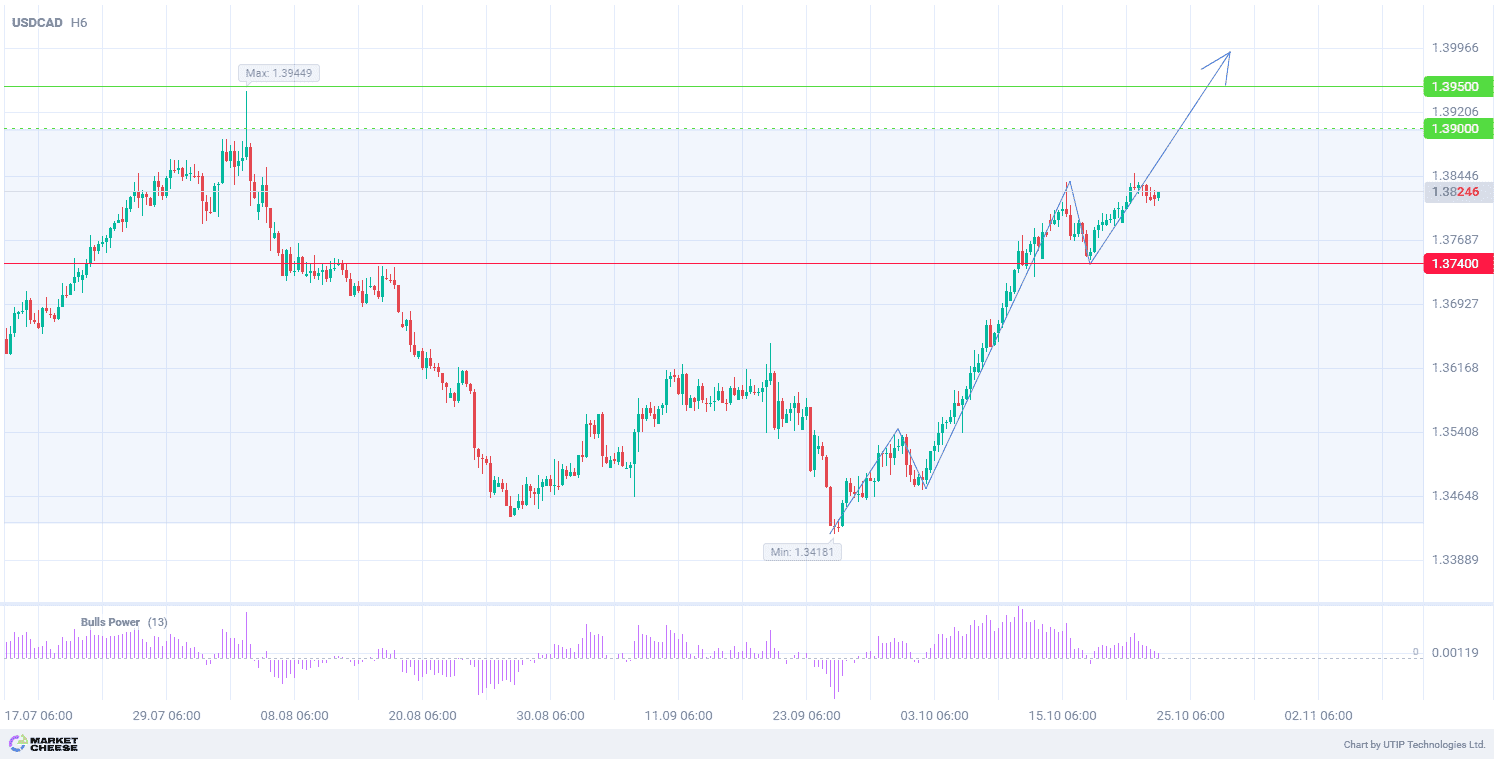

The technical picture for USDCAD is showing a new upward trend, with the pair trading within a broad channel on the D1 timeframe. The wave analysis of the H6 chart is showing the formation of the fifth ascending wave. The volume of the Bulls Power indicator (default values) is in the positive zone, confirming the uptrend.

Signal:

Short-term prospects for USDCAD suggest buying.

The target is at the level of 1.3950.

Part of the profit should be taken near the level of 1.3900.

A stop-loss could be placed at the level of 1.3740.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance.