04 марта 2025

Sellers retain control of TSLA with price target at 187.10

Tesla (TSLA) stock finished yesterday’s trading session with no significant changes. However, fundamental factors continue to exert pressure on the asset. The US-China trade standoff and the Trump administration’s tougher tariff policy are increasing risks for the electric vehicle sector.

Despite the fact that Tesla’s mass-market models (Model 3 and Model Y) produced in Shanghai are not subject to new tariffs, the market remains cautious. Tesla has suspended orders for Model S and Model X in China, adding uncertainty to the market, even though these models account for less than 0.5% of all deliveries in the country.

Even the limited impact of external factors could deepen the correction in stocks in the absence of new growth drivers.

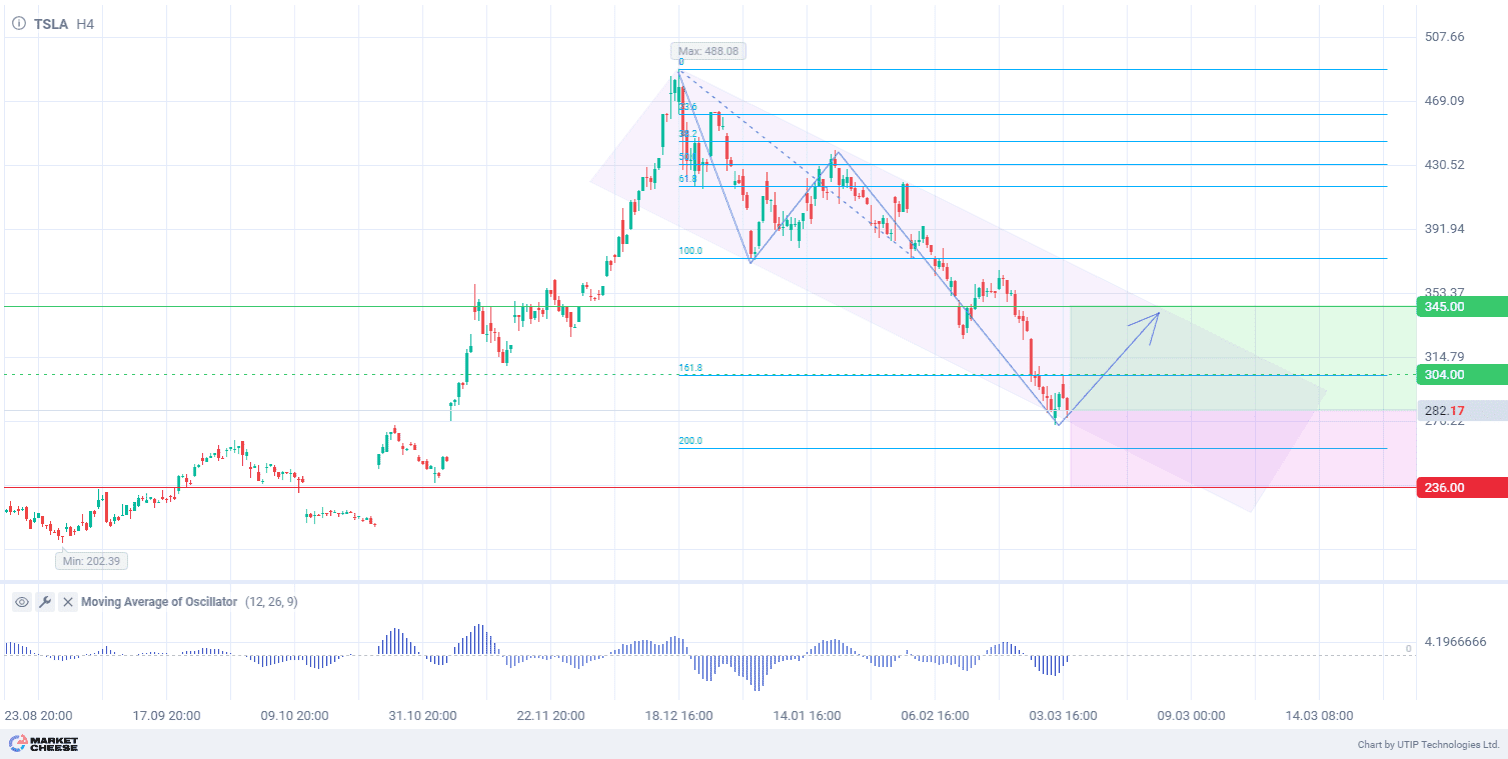

Technical analysis suggests that TSLA’s share price is maintaining a downtrend on the H4 timeframe, developing within a five-wave structure. The fifth wave has been forming since March 27. The downside target is located at 187.10, meeting the 261.8% Fibonacci extension level.

After a short rise from the 214.00 low, a corrective sub-channel has formed with small bodies and long upper shadows dominating within it. This indicates the weakening of the buying impulse and a possible completion of the corrective phase.

The Bears Power indicator (13, Open) remains below zero, reflecting the continued dominance of sellers despite short-term consolidation attempts.

The current configuration confirms the downward trend and corresponds to the development of the final phase of the five-wave movement.

Short-term prospects for TSLA stock price suggest selling with the target at 187.10. Partial profit taking is recommended around 223.40. A stop loss could be set at 307.00.

Since the bearish scenario is short-term, trading volume should not exceed 2% of your total balance to reduce risks.