11 ноября 2024

Gold is under pressure due to expectations of economic policies from Trump

Gold prices fell 0.5% on Monday, declining for the second consecutive session. The US dollar remains stable, staying below the 4-month high reached last week amid optimistic market sentiment about Donald Trump’s expected economic policies. His promises to cut corporate taxes as well as support for risk appetite have been key pressures on commodities. This led to outflows from gold as a protective asset.

Trump’s plans to boost economic growth and inflation could also limit the Federal Reserve’s (Fed) options for more decisive interest rate cuts. This keeps US Treasury bond yields higher and puts additional pressure on the yellow metal, which is not generating interest income.

According to the CME FedWatch tool, traders estimate a 65% chance of a 25-basis-point rate cut in December and a 35% chance of keeping the rate unchanged.

Several Fed officials are expected to speak this week, including Chairman Jerome Powell. Some important economic data, such as US consumer and manufacturing price indices, jobless claims and retail sales, will also be released.

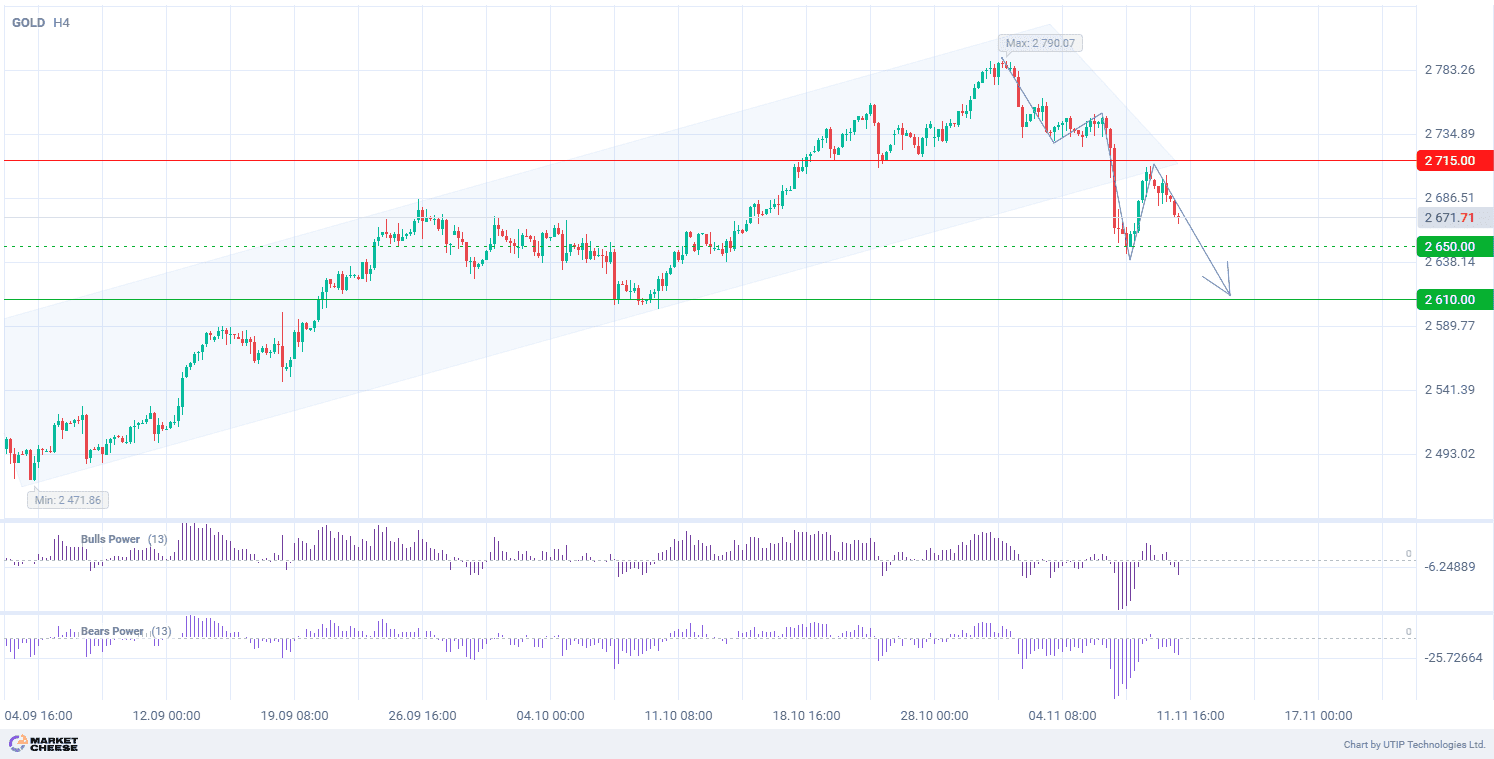

At the technical level, gold prices are forming a new downtrend after exiting the uptrend on the H4 timeframe. Wave analysis indicates the development of the 5th downward wave. The volumes of Bulls Power and Bears Power indicators (with standard settings) are in the positive zone, confirming the downtrend.

Signal:

The short-term outlook for GOLD suggests selling.

The target is at the level of 2610.00.

Part of the profit should be taken near the level of 2650.00.

A stop-loss could be placed at the level of 2715.00.

The bearish trend is short-term, so a trading volume should not exceed 2% of your balance.