13 ноября 2024

EURUSD is going down due to a stronger dollar and EU economic risk

The EURUSD currency pair keeps declining for the fourth consecutive day trading below the level of 1.07 on Wednesday. The euro remains under pressure, mostly because of a stronger US dollar.

The rise in the dollar is driven by expectations of the Donald Trump administration’s new fiscal policy, which may increase investment and government spending, supporting economic activity. However, this activity could trigger inflation risks forcing the Federal Reserve (Fed) to reconsider its hawkish stance on interest rates.

As Minneapolis Fed President Neel Kashkari said, the Fed remains committed to curbing inflation which is still above the 2% target.

Today, investors are awaiting the publication of the US Consumer Price Index (CPI). Other important economic data from the States will also come out this week, including the Producer Price Index (PPI), weekly jobless claims and retail sales data.

On Thursday, the market will focus on the updated EU GDP data for the third quarter. Traders expect the preliminary rise of 0.4% to be confirmed. If the annual GDP forecast is at 0.9%, this will indicate weak economic activity in Europe.

In addition, the London School of Economics stressed that Trump’s imposition of 10% tariffs on imported goods could reduce EU economic growth by 0.1%. This will negatively affect the outlook for the euro against the dollar.

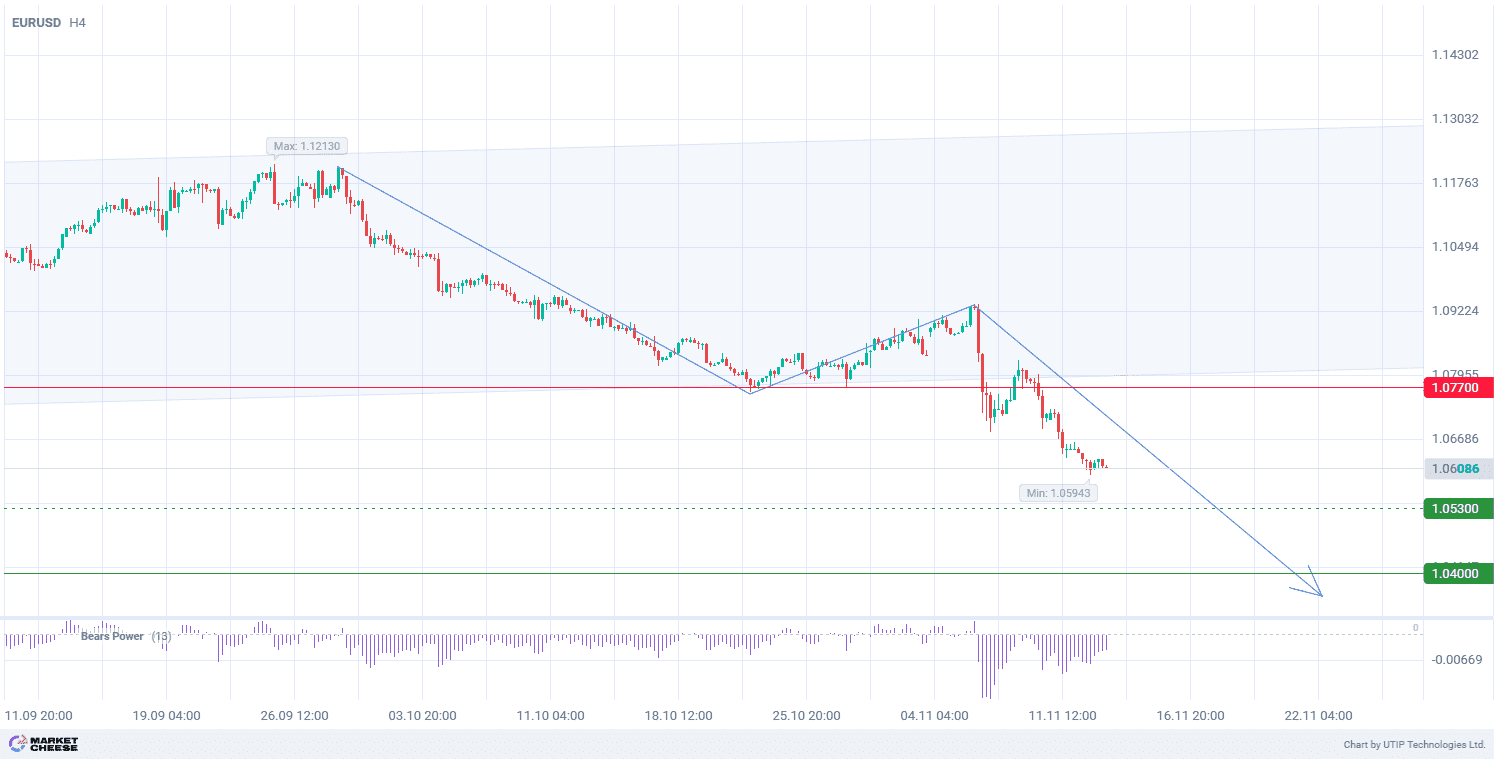

At the technical level, EURUSD accelerates the downward movement on the D1 chart after breakout from the upward channel.

In terms of wave analysis, the third downward wave is forming on the H4 timeframe. Breaking through the lower limit of the first wave at 1.0760 has already taken place, indicating a probable strengthening of the downward momentum. The Bears Power indicator (standard values), which is in the negative zone, confirms the bearish sentiment and suggests further selling.

Signal:

The short-term outlook for EURUSD suggests selling.

The target is at the level of 1.0400.

Part of the profit should be taken near the level of 1.0530.

A stop-loss could be placed at the level of 1.0770.

The bearish trend is short-term, so a trading volume should not exceed 2% of your balance.