17 October 2024

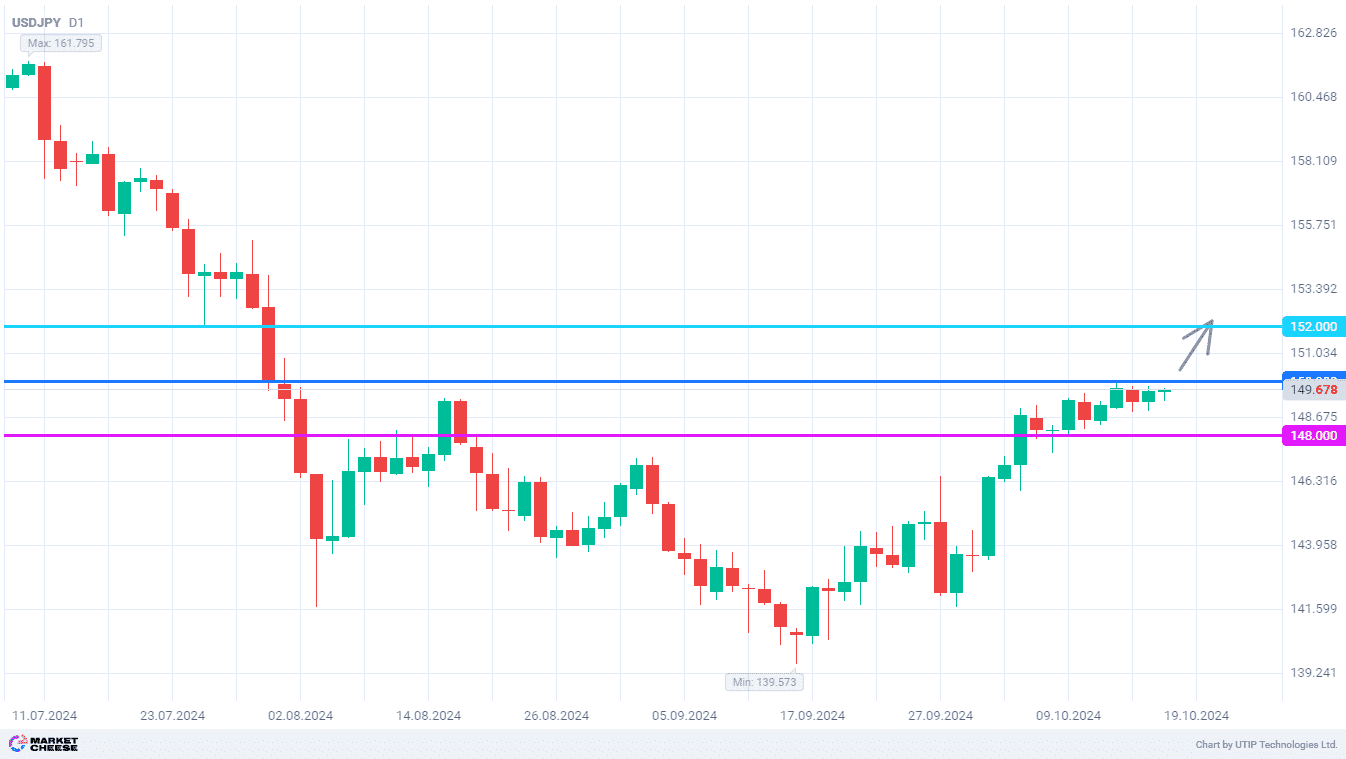

USDJPY is poised to return above level 150

The USDJPY currency pair has been consolidating since the middle of last week, moving within the range of 148-150. At the same time, the quotations are getting closer to the upper boundary of this sideways range, and in the nearest future the bulls may start attacking this target. A breach above the 150 level will open a way to further price increase, and the next aim of buyers of the dollar against the yen will be the level of 152. With the news background support, this scenario may materialize within a few days.

In particular, the Japanese trade data released today is clearly negative for the currency. Exports in September fell by 1.7%, marking the worst result since February 2021. The supply dynamics to all key markets turned out to be negative: -2.4% in the US, -7.3% in China, and -9% in Europe. According to Bloomberg experts, stimulus measures of the Chinese authorities will support the country’s economy, and Japanese companies will face an even more challenging competitive environment in the global market.

Under such conditions, the Bank of Japan has to be extremely cautious about further interest rate hikes. This opinion was voiced by the regulator’s official Seiji Adachi in his speech. According to him, the main goal of the central bank was to abandon ultra-soft monetary policy, and it has already been accomplished, so all further steps in this direction should be taken very carefully. Adachi’s comments are in line with Japanese Prime Minister Shigeru Ishiba’s statements about the national economy’s not being ready for higher interest rates.

Against this background, an increasing number of market participants forecast no changes in the Bank of Japan’s policy at the nearest meetings. According to a Reuters poll, the key rate will remain at the current level of 0.25% until the end of 2024. Its increase may be possible no earlier than in January or even March. Inaction makes the yen vulnerable to a new wave of decline, but the current levels of USDJPY are unlikely to cause the regulator to respond via currency interventions.

A breakthrough of the 150 level up from below will be a good encouragement to open long positions on USDJPY. After that, the quotations may quickly reach the level of 152.

The following trading strategy variant may be suggested:

Buy USDJPY near the level of 150. Take profit – 152. Stop loss – 148.