18 April 2025

USDCAD to rise from new support at 1.38200

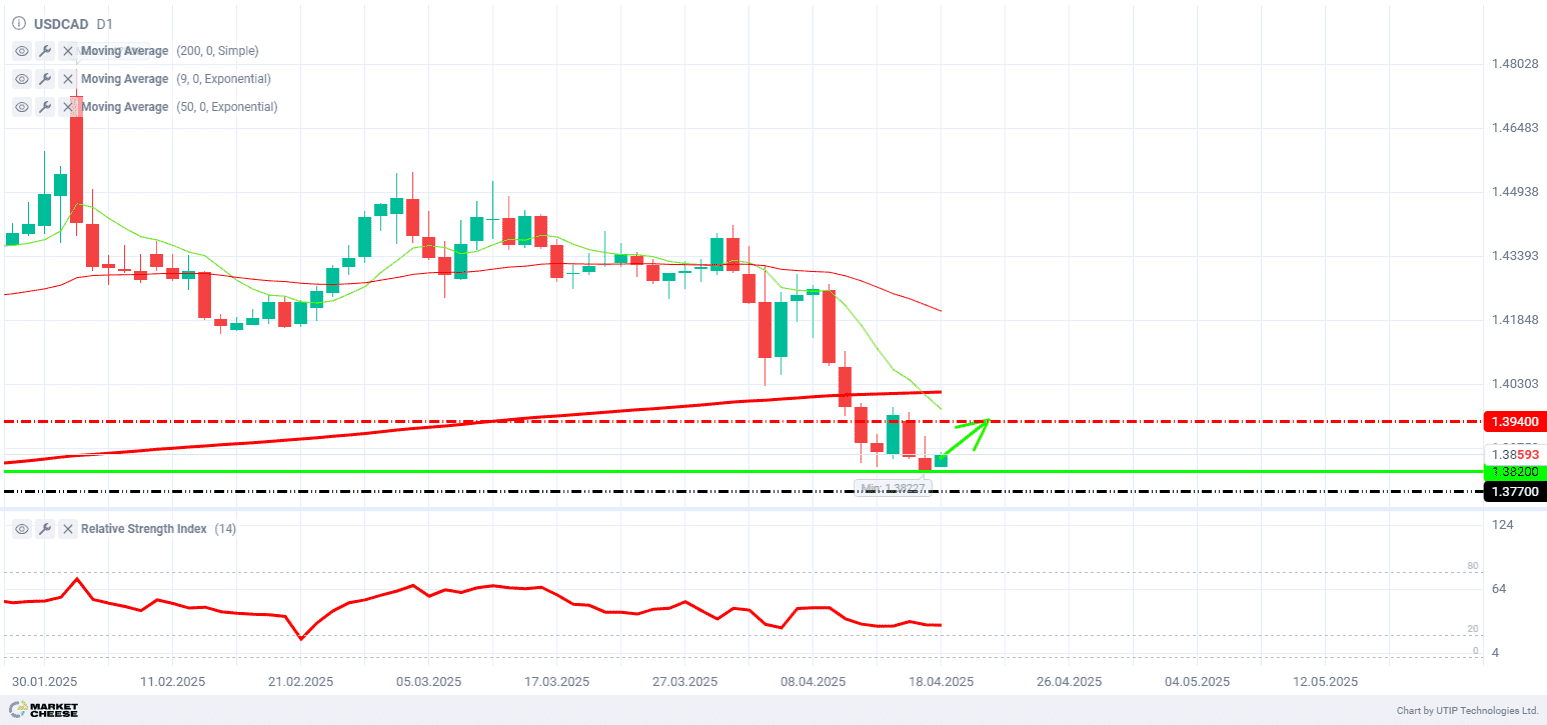

The USDCAD currency pair broke through the previous support level of 1.39400 last Friday, April 11. At the start of this week, the rate consolidated below this level, which has now transformed into a resistance. On Tuesday and Wednesday, the price attempted to test this resistance again but was unsuccessful. Currently, the pair is trading near the next support level of 1.38200.

The price has settled below the 200-day simple moving average, a level that the currency pair has typically traded above for most of its historical data. This moving average of 1.40000 now serves as a potential target for price growth.

The Relative Strength Index (RSI) on the daily timeframe stands at 28, approaching the oversold zone, which indicates a potential shift in sentiment towards buying the asset in the near future.

Despite heightened tensions between Canada and the US, Canadians purchased a record amount of American stocks in February, coinciding with US equity markets reaching an all-time high, according to official data released on Thursday.

Statistics Canada reported that Canadians acquired CAD 29.8 billion worth of US stocks, primarily targeting large-cap technology and financial companies. In contrast, they sold CAD 15.6 billion worth of shares in January.

The benchmark US oil price is currently at $63 per barrel, down from $75 just two weeks ago. As the largest exporter of oil to America, Canada typically sees a negative impact on the value of its national currency when crude oil prices decline.

The Bank of Canada (BoC) has outlined two scenarios regarding the impact of Trump’s tariff policy on Canada’s economic outlook. In the first scenario, if most tariffs are lifted, Canadian and global GDP growth would experience a temporary slowdown, with inflation potentially dropping to 1.5% for a year before returning to the central bank’s 2% target. In the second scenario, prolonged global trade tension could push the Canadian economy into a deep recession, with inflation rising above 3% by mid-2026 before stabilizing at 2%.

Consider the following trading strategy: buying USDCAD at the current price with a Take Profit set at 1.39400 and a Stop Loss at 1.37700.