06 November 2024

US election results send EURUSD to summer lows

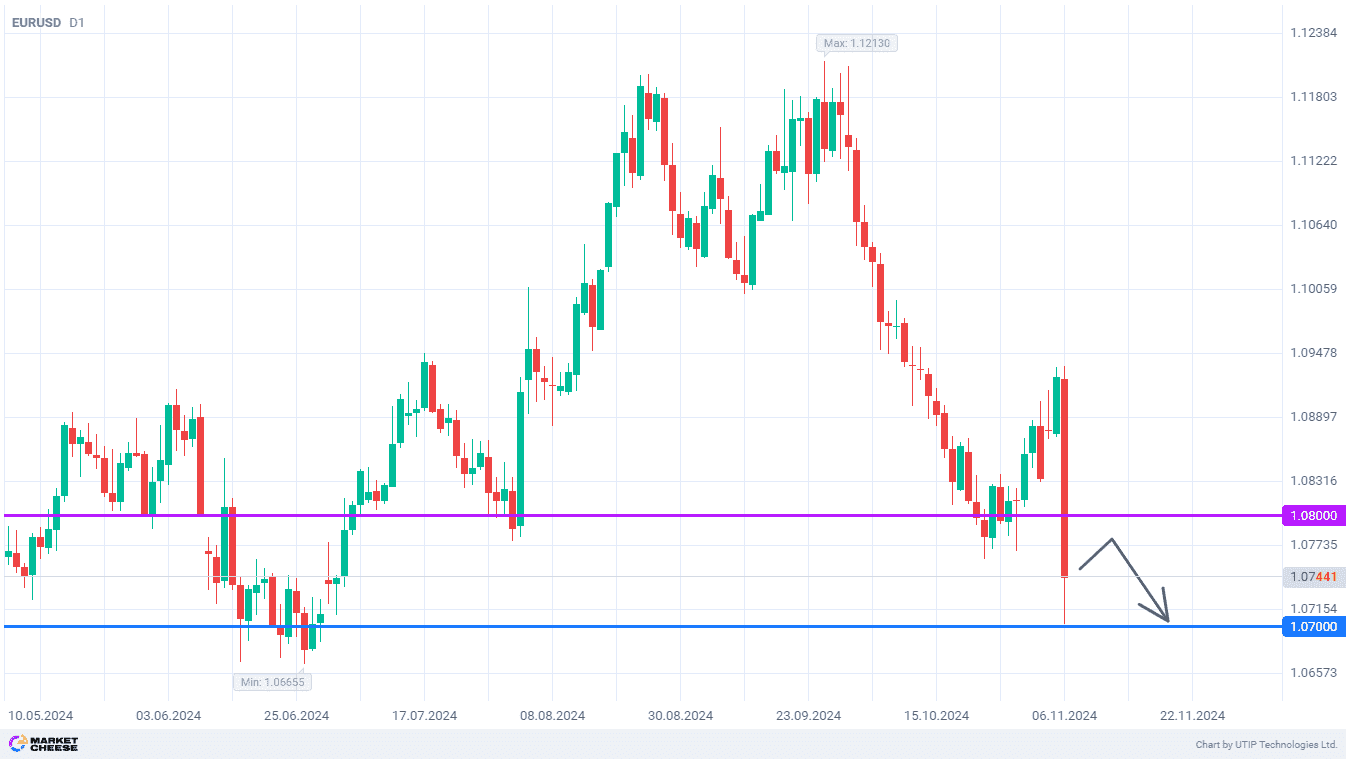

The EURUSD currency pair started Wednesday’s trading session with a sharp decline. Quotes canceled out all the gains of the last two weeks and fell to the level of 1.07. Just below this mark there are the June lows, which the price can still reach within the current downward momentum. Without even considering the fact that emotions are prevailing on the financial markets, the dollar has a significant fundamental advantage against the euro.

Today’s surge in the US currency may be the biggest since March 2020. The first results of the US presidential election showed Donald Trump’s advantage. This led to a sharp rise in Treasury bond yields and provided support for the dollar. Trump’s economic policy is likely to ensure that interest rates in the country remain high for an extended period of time, Bloomberg suggests.

The latest statistics from the US also speaks in favor of such a scenario. According to ISM, the PMI in the services sector amounted to 56 in October. This was the highest value since August 2022. In September, the index was at 54.9. It’s unlikely that this will affect the Fed’s decision to cut the key rate by 0.25% on Thursday, but a repeat of September’s move of 0.5% is out of the question. Besides, more and more market participants are talking about the possibility of a pause in the monetary easing cycle in December.

Meanwhile, for the euro, Donald Trump’s potential return to the White House carries risks of a serious decline. According to Bloomberg, traders were turning to the Swiss franc and other safe haven assets in recent days. If taxes on imports of European goods in the US increase, the ECB will have to continue reducing rates, otherwise it will be very difficult for the EU economy to get out of stagnation. Some investors started talking again about the possibility of reaching parity in EURUSD quotes.

The first bearish attack at 1.07 on EURUSD was repulsed, but with the start of trading on the US exchanges the selling pressure may intensify. If successful, the next target will be the summer low at 1.0665.

The following trading strategy can be suggested:

Sell EURUSD in the range of 1.074–1.076. Take profit — 1.07. Stop loss — 1.08.