25 November 2024

Silver buyers get ready to test 31.5 level

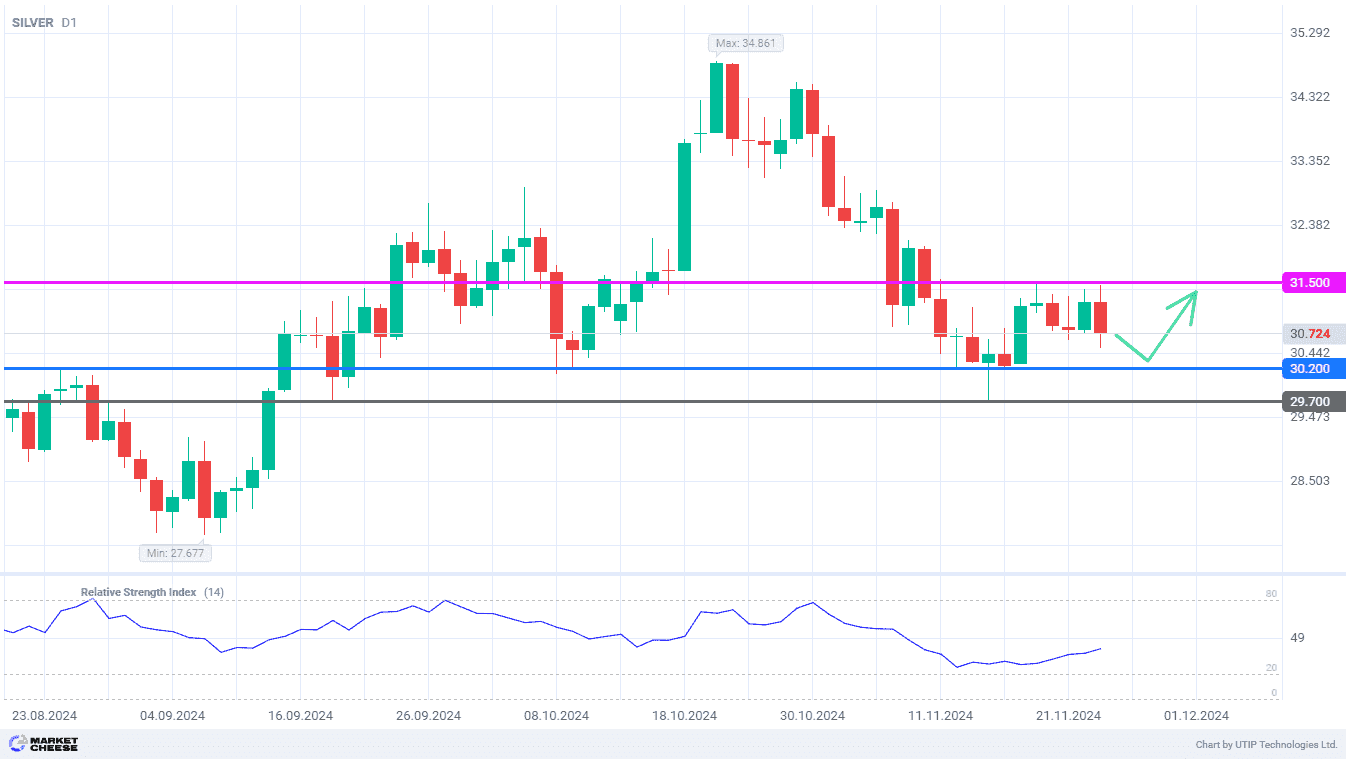

Last week, silver prices managed to break out of the downtrend, they had been in since the end of October. Prices stabilized in the range of 30.2–31.5 and tested the upper boundary several times. It was not possible to break it from below upwards yet, but it also leaves an opportunity for profitable opening of long positions. The improvement of the technical and fundamental picture allows expecting a new wave of growth in silver prices.

According to FXEmpire analysts, now only the strong dollar puts pressure on silver prices. However, just this circumstance is favorable for adding silver to an investment portfolio, until its price returned to an active increase. Silver has a low correlation with other financial market assets, providing the advantage of diversification. In addition, silver has historically been a good hedge against inflation and devaluation of national currencies.

A combination of the properties of a safe haven asset and industrial raw materials leads to a stable growth in demand for silver. According to market participants, the deficit of silver in the current year will be from 182 to 265 million ounces. Silver consumption by the end of 2024 may exceed 1.2 billion ounces for the first time, but the global mining industry cannot provide such a supply. The source of the missing supply is still accumulated stockpiles and secondary processing, but they are unlikely to be enough for a long time.

In addition, the situation with silver supplies may be worsened by the proposed tax increase for mining companies by the Mexican authorities. The country’s industry association announced a potential reduction in investments by almost $7 billion over the next 2 years. This bill comes after a sharp reduction in license terms, as well as Mexican officials continue to consider a ban on open-pit mining. These are all negative factors for Mexico as the world’s leading silver producer.

The RSI indicator on the daily chart of silver continues to grow, supporting new purchases. In the near future, there is a high probability of a new test of the 31.5 level.

Consider the following trading strategy:

Buy silver in the range of 30.2–30.7. Take profit – 31.5. Stop loss – 29.7.