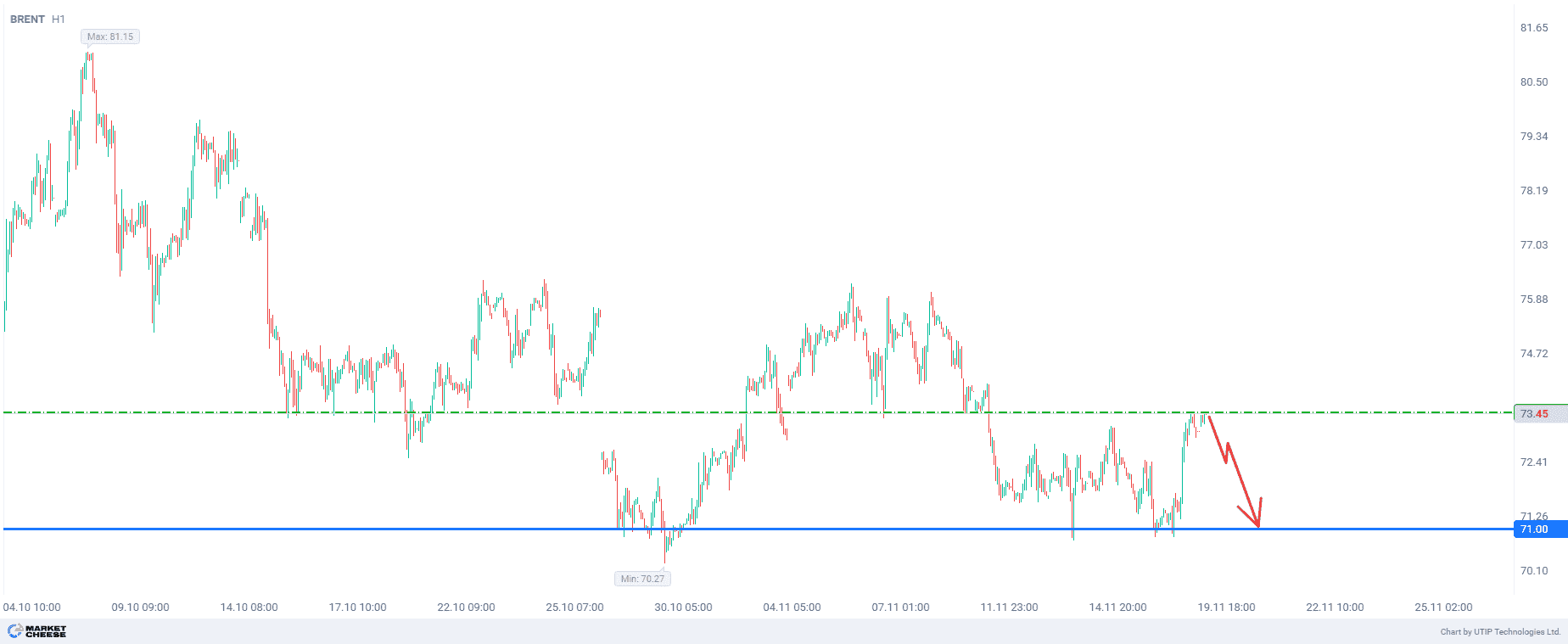

19 November 2024

Selling Brent with target at $71.0 per barrel

According to the latest data concerning the state of the world oil market, the conditional turning point, which will trigger a free fall in oil prices, is getting closer and closer.

A key oil market gauge is showing signs of excess supply in the US, which is the latest sign of a looming global oil surplus.

The so-called prompt spread, which measures the difference in price between futures for immediate delivery and those a month later, traded in negative territory for the first time since February. This reflects a bearish contango pattern, a signal that short-term supplies are enough to cover all the demand.

The International Energy Agency warns of a more than 1 million barrel-a-day excess supply in its November report. Reserves could rise further if OPEC and its allies unwind production cuts next year.

Inventories at the futures delivery point at Cushing, Oklahoma, are basically in line with recent seasonal norms, but US crude production continues to surge to new records of more than 13 million barrels a day. This comes as oil consumption in China, the world’s largest crude consumer, declined for six straight months through September, according to the IEA.

From the technical point of view, oil prices are all set to fall. Bearish patterns have been formed on both medium and large timeframes.

There are three downside targets for Brent Crude Oil. The first one is at $71.00 per barrel. This level will probably be reached in the next few days.

The second target for Brent is at $58.00 per barrel, and the third is at $47.

The market can be full of surprises, so right now we need to go with the most likely scenarios, which means we will focus on the first target.

The overall recommendation is to sell Brent oil.

Profits should be taken at the level of 71.00. A Stop loss could be set at the level of 76.00.

The volume of the opened position should be set in such a way that the value of the possible loss, fixed with the help of a protective Stop loss order, is no more than 1% of your deposit funds.