25 November 2024

Gold loses ground as demand for safe haven assets wanes

Gold prices are declining after reaching a nearly three-week high during the Asian session on Monday, breaking a five-month rally. The appointment of Scott Bessent as US Treasury Secretary at the initiative of newly elected President Donald Trump removed one of the key uncertainties for the markets. This strengthened investors’ confidence in the stability of the U.S. economy. Also, reports about possible de-escalation of the conflict in the Middle East contributed to the improvement of market sentiment and reduced interest in gold as a safe haven asset.

Market expectations suggest that Trump’s economic policies could increase inflationary pressures, limiting the Federal Reserve’s (Fed) ability to continue interest rate cuts. Against this backdrop, gold remains subject to correction. At the same time, its further dynamics will depend on the release of key macroeconomic data and political decisions.

According to CME FedWatch, the probability of a 25 basis point rate cut in December fell from 62% to 51% from last week.

This week, investors are focused on the release of minutes of the Federal Reserve’s November meeting, GDP data and the core US personal consumption expenditure (PCE) index.

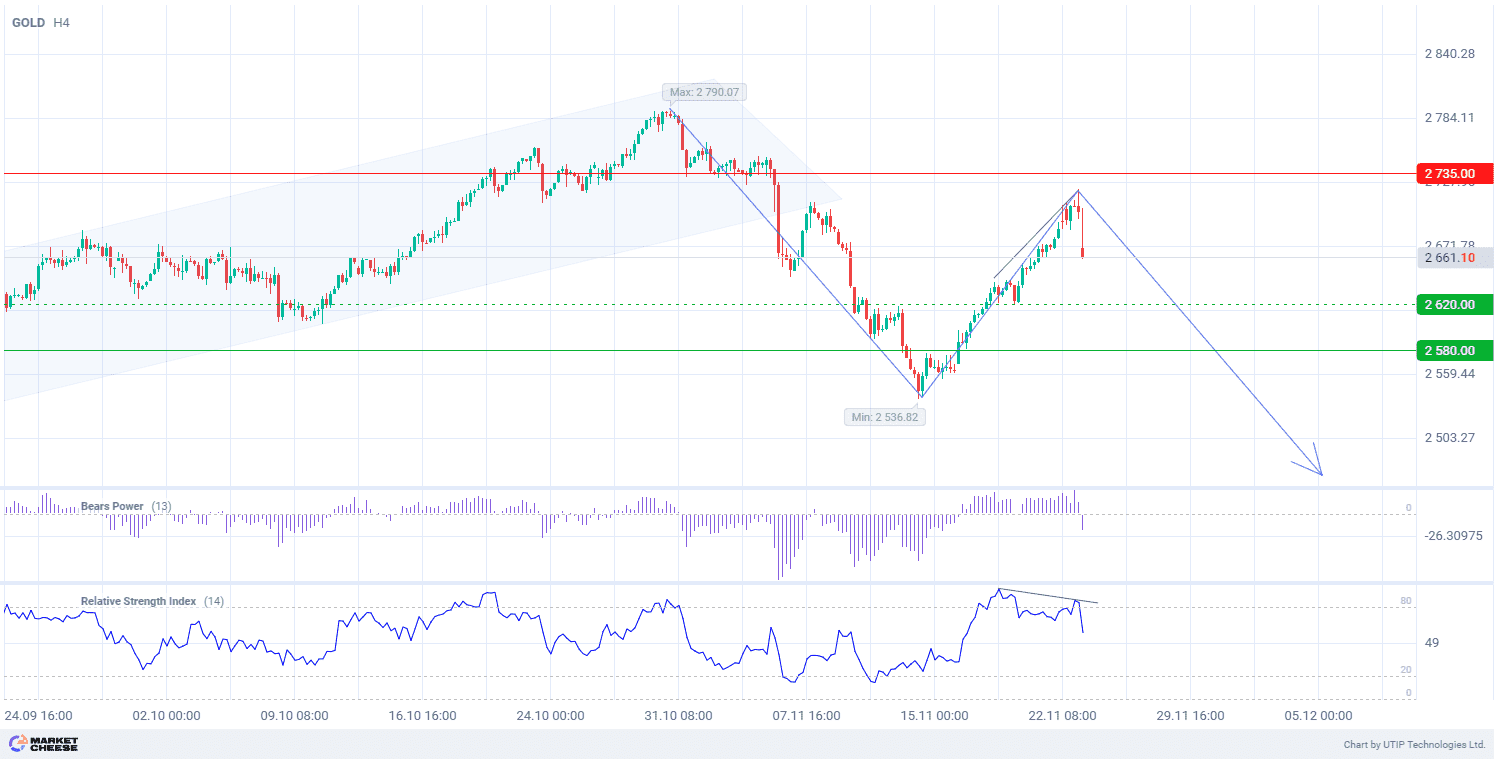

From a technical point of view, gold quotes show the formation of a downtrend after the exit from the uptrend on the timeframe H4. The wave analysis indicates the development of the second upward wave, but the Relative Strength Index (RSI) indicator shows divergence, indicating the possibility of transition to the third downward wave. The Bears Power indicator volumes have moved into the negative zone, confirming the probable decline in the rate.

Signal:

The short-term outlook for GOLD suggests selling.

The target is at the level of 2580.00.

Part of the profit should be taken near the level of 2620.00.

A stop-loss could be placed at the level of 2735.00.

The bearish trend is short-term, so a trading volume should not exceed 2% of your balance.