18 April 2025

GBPUSD technical correction opens up selling opportunities with 1.288 target

The pound strengthened against the US dollar on Thursday, following economic data from the past week that alleviated concerns about the impact of US tariffs on the British economy. The GBPUSD exchange rate opened at 1.32709 on Friday.

On Thursday, the dollar index experienced a rise, suggesting that its recent weakness against other currencies may have reached a temporary limit.

Meanwhile, UK inflation is anticipated to decline over the next year, driven by lower energy costs and a firmer pound.

Market analysts estimate that there is over an 80% chance the financial regulator will cut interest rates by a quarter of a percentage point in May, with expectations for an additional decrease of about one percentage point by the end of 2025.

The Bank of England is proceeding with rate cuts more cautiously than many other regulators, as it is anticipating an acceleration in price growth. However, according to Bloomberg, more recent data leading up to the May meeting could provide a compelling case for easing monetary policy.

It is important to note that the pound may face pressure due to the implications of the UK government’s tax reform. Although the reform aims to stimulate economic growth, it could also pose risks for the national currency.

Next week, on April 23, data regarding business climate in the UK manufacturing sector is expected to be released.

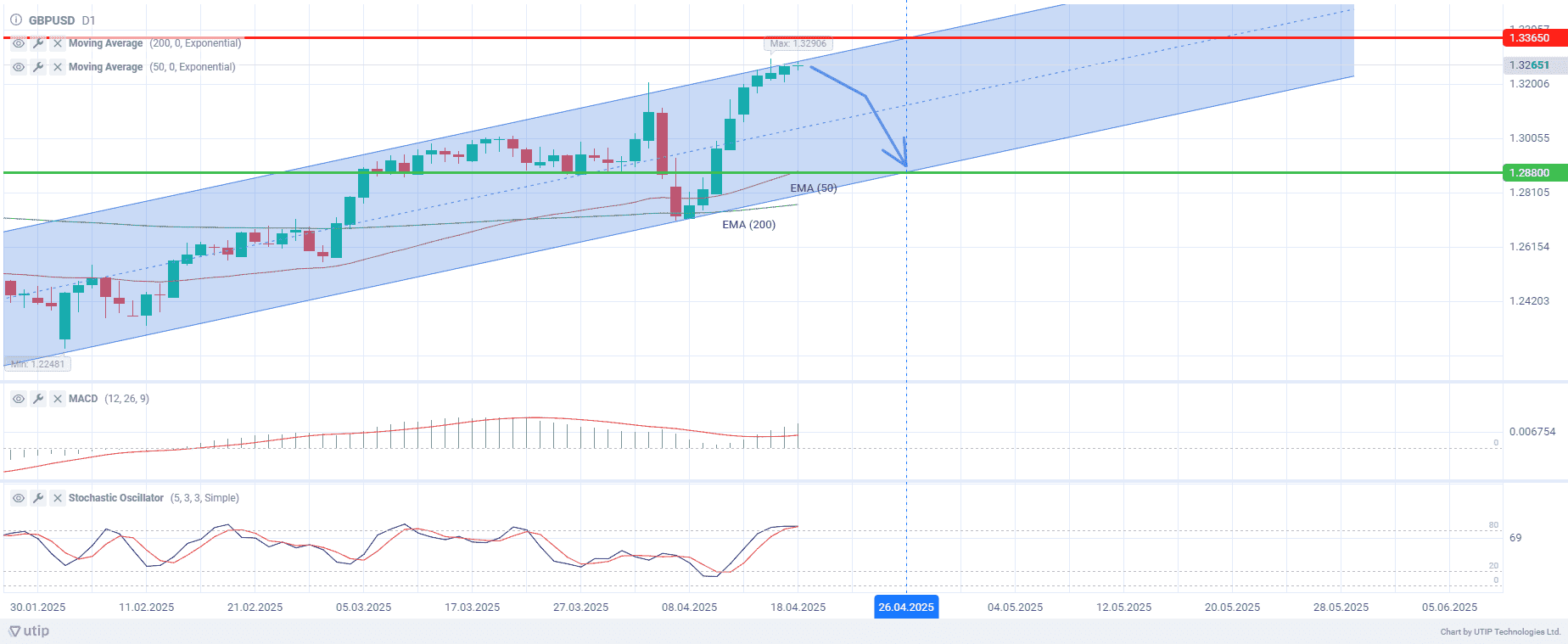

Technical analysis of GBPUSD indicates that the currency pair is currently in an uptrend, showing signs of being overbought and signaling a potential correction. The MACD remains positive, with the gap between the signal line and the main line widening, reinforcing the overall bullish sentiment. However, the Stochastic Oscillator suggests that the pair is already overbought, which could lead to a swift price decline.

The D1 chart reveals that the price is firmly positioned above both the long-term moving average (EMA(200)) and the short-term moving average (EMA(50)), a characteristic of an uptrend. Additionally, EMA(200) is situated below EMA(50), further supporting the bullish outlook.

Current recommendation:

Sell at the current price within the correction. Take profit — 1.288. Stop Loss — 1.3365.