26 November 2024

GBPUSD is targeting 1.2300 level as selling pressure increases

Quotes of the GBPUSD currency pair are down on Tuesday, approaching seven-month lows and the key psychological level of 1.2500.

The US dollar is holding its ground amid expectations of market participants about the future economic policy of US President-elect Donald Trump. His plans are expected to boost inflation and slow the pace of interest rate cuts by the Federal Reserve (Fed).

The appointment of Scott Bessent as US Treasury Secretary caused a short-term increase in Treasury bond yields, strengthening the dollar’s position. In addition, geopolitical risks associated with the tense situation in Eastern Europe and the Middle East continue to support demand for the dollar as a safe haven asset. These factors limit the GBPUSD recovery potential.

Nevertheless, a sustained decline of the pair below the psychological mark of 1.2500 remains questionable. The data published last week showed an acceleration of core inflation in the UK to 2.3% year-on-year in October. This reduces the probability of a drastic rate cut by the Bank of England, supporting the pound.

Investors are looking forward to the release of the minutes of the November FOMC meeting, which could provide clues as to the Fed’s future monetary policy. Also, in the spotlight are the revised data on US GDP growth for the third quarter and Personal Consumption Expenditures (PCE) index. These publications will have an important impact on the short-term dynamics of the currency pair.

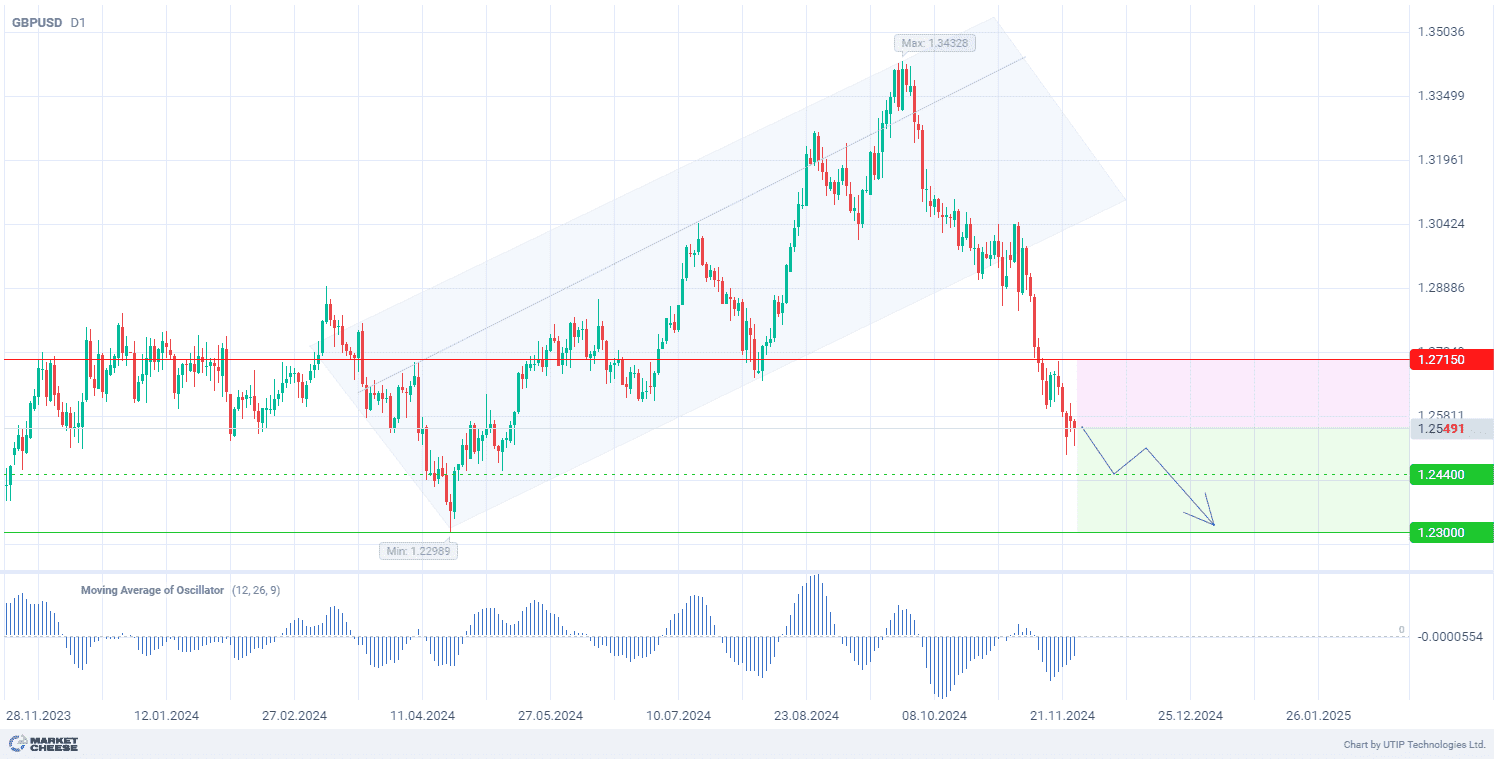

Technical data on GBPUSD demonstrates the formation of a downtrend on the daily timeframe (D1). The bearish acceleration is noted after the quotes exit from the uptrend. The Moving Average of Oscillator indicator volumes (with parameters 12, 26, 9) are below zero, signaling the remaining potential for price decline.

Short-term prospects for the GBPUSD currency pair suggest selling, with the target at 1.2300. Part of the profit should be taken near the level of 1.2440. A Stop-loss could be set at 1.2715.

Since the bearish trend is short-term, the trading volume should not exceed 2% of your total balance to reduce risks.