16 October 2024

EURUSD on track to break uptrend due to expectations of ECB rate cut

On Wednesday, the EURUSD currency pair maintained its downtrend that began in late September. The downward pressure may increase as the market expects the European Central Bank (ECB) to cut the interest rate by 25 basis points at its upcoming meeting on Thursday.

Traders will also keep a keen eye on the Eurozone’s Harmonized Index of Consumer Prices (HICP) data, which will be released on Thursday. The data is important as it could influence the ECB’s future monetary policy.

Other key events of the week include the publication of the central bank’s monetary policy statement and President Christine Lagarde’s speech at a press conference. These events may give a clearer picture of the regulator’s future plans.

The US dollar index remains near a two-month high of 103.15. Strong US employment and inflation data have reduced expectations of aggressive rate cuts by the Federal Reserve in 2024.

Market participants’ attention is now focused on the publication of Thursday’s data on retail sales, industrial production, and jobless claims in the United States. These indicators may give new signals about the Fed’s future strategy. The probability of a 25 basis point rate cut in the United States in November is estimated at 97.2%, according to the CME FedWatch.

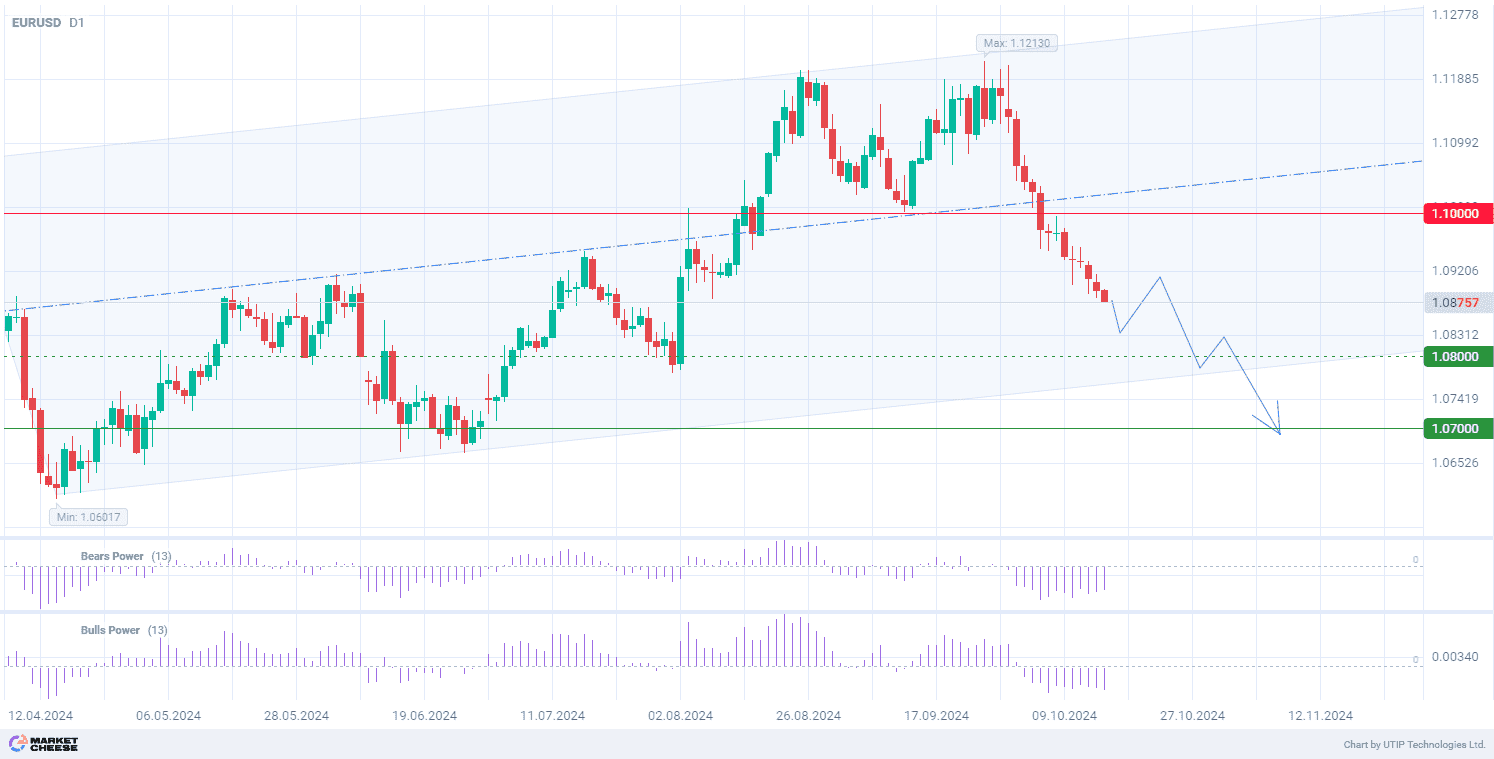

From a technical point of view, the EURUSD quotes on the D1 timeframe are in a broad corrective upward channel. The price has overcome the local trend support and accelerated in a bearish direction towards the main support. The volumes of Bulls Power and Bears Power indicators (standard values) are in the negative zone, confirming the downward trend. More explicit statements from the ECB at the upcoming press conference may lead to the pair’s exit from the ascending channel.

Signal:

The short-term outlook for the EURUSD pair suggest selling.

The target is at the level of 1.0700.

Part of the profit should be taken near the level of 1.0800.

A stop loss is located near the level of 1.1000.

The bearish trend has a short-term nature, so it is worth selecting a trading volume of no more than 2% of the balance.