27 November 2024

EURUSD is poised to surge higher as correction continues

The EURUSD currency pair stabilized on Wednesday after an impulsive decline recorded in the previous trading session. Today, traders focused on the release of data on the Personal Consumption Expenditures (PCE) index and US quarterly GDP.

The dollar weakened due to optimism in the bond market caused by the appointment of Scott Bessent, a well-known supporter of tight monetary policy, as US Treasury Secretary. However, the minutes of the November meeting of the Federal Open Market Committee (FOMC) point to the Federal Reserve’s (Fed) cautious approach to further interest rate cuts. According to the document, easing of monetary policy will accelerate only if there are significant problems with employment or inflation.

The euro remains under pressure due to the threat of new tariffs announced by US President-elect Donald Trump. His strategy to impose duties on China, Mexico and Canada is worsening market sentiment and weakening the outlook for economic growth in the eurozone.

Meanwhile, in Europe, expectations of a 25 basis point interest rate cut by the European Central Bank in December increased. The probability of a larger 50 basis point cut rose to 58%, reflecting growing economic concerns.

At the technical level, EURUSD quotes on the D1 chart are accelerating downward movement after leaving the ascending channel.

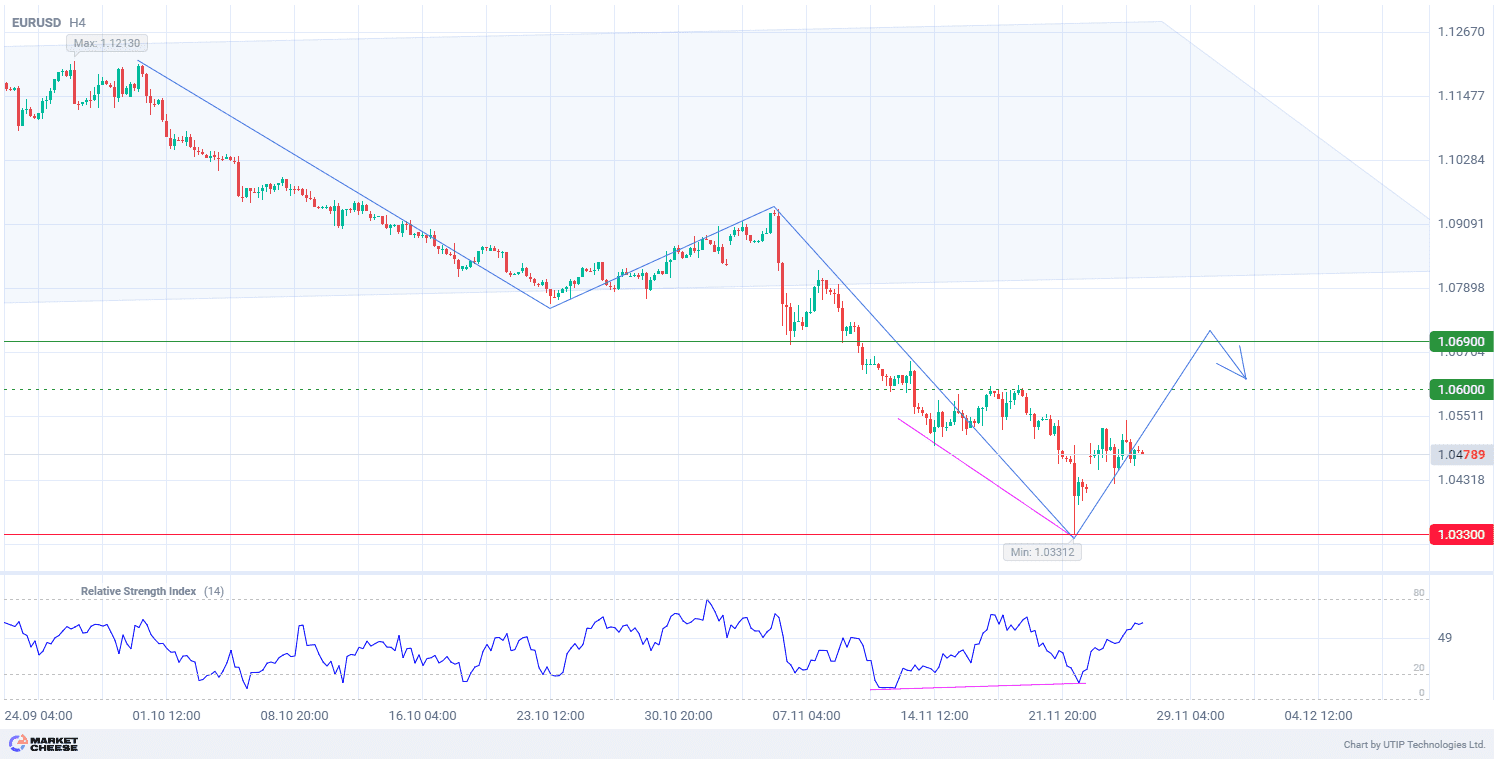

In terms of wave analysis, the third descending wave is being formed on the H4 timeframe. However, its potential is worked out, which will be cut off in the current price correction. Additionally, the Relative Strength Index (RSI) indicator shows divergence, indicating the possibility of transition to the fourth upward corrective wave.

Signal:

The short-term outlook for EURUSD suggests buying.

The target is at the level of 1.0690.

Part of the profit should be taken near the level of 1.0600.

A stop-loss could be placed at the level of 1.0330.

The bullish trend is short-term, so a trading volume should not exceed 2% of your balance.