25 March 2025

Buying AUDUSD amid correction with target at 0.633

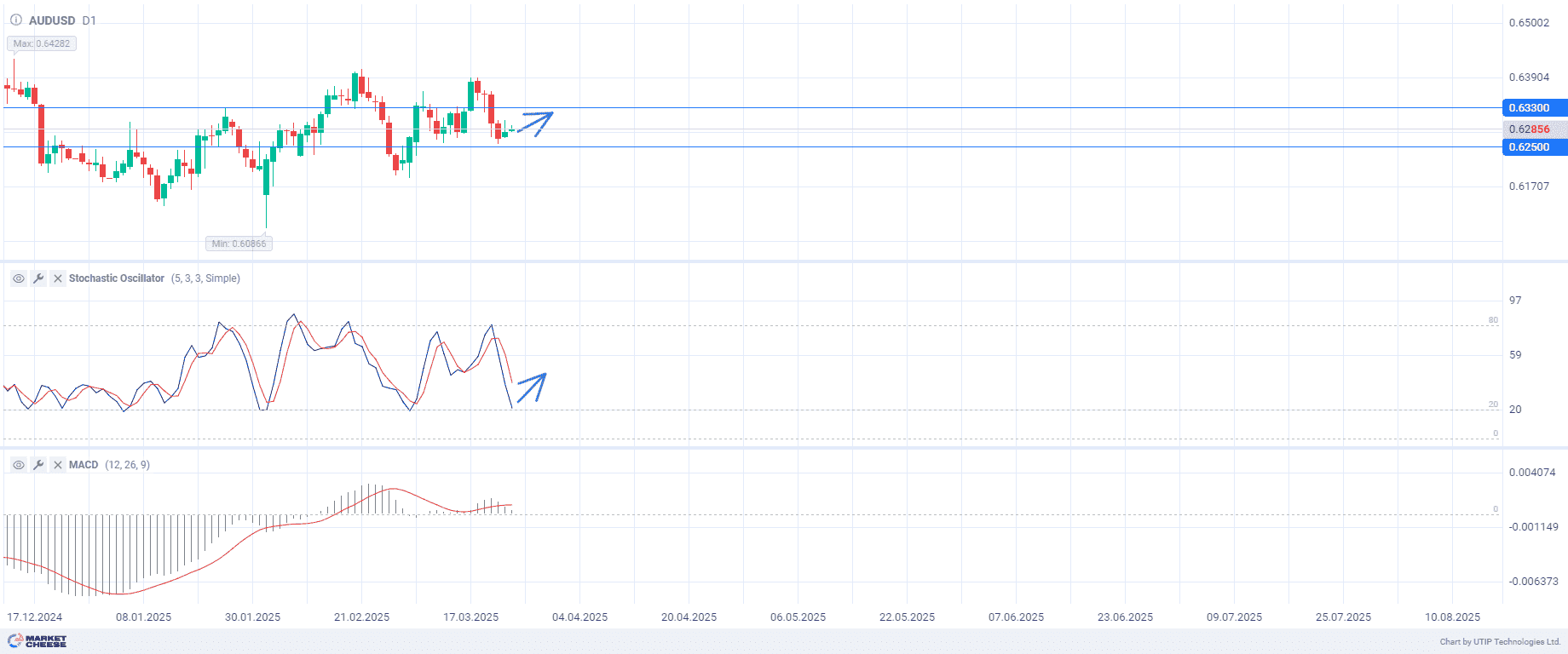

On Tuesday, the currency pair AUDUSD grew and started recovering last week’s losses. Last week, the pair declined 1.82%. On March 25, the opening price was 0.62825.

AUD fell after USD strengthening amid concerns around the US trade policy and strong data on services. US President Donald Trump stated not all of the planned duties would be imposed on April 2 and some countries may get breaks. The comments improved Wall Street’s sentiment and dispelled some worries around a slowdown in the US economy.

Additionally, USD was positively impacted by S&P Global’s data on US services PMI, which showed a steady growth. The data boosted the US stock returns and supported the currency.

Nevertheless, the manufacturing PMI data turned out to be less optimistic. The sector’s PMI index fell below the critical mark, separating growth from contraction in economic activity. The mixed statistics creates uncertainty about the Fed’s next move and US economic outlook.

The Australian dollar is also under pressure due to weak employment data. Despite the unemployment rate of 4.1%, a drop in employment has raised concerns about the state of the labor market.

Disappointing data fuelled speculation about a possible interest rate cut by the Reserve Bank of Australia (RBA). A weak labor market can give RBA’s monetary policy more room to maneuver.

The nearest important event will be the release of the US GDP data on March 27. Besides, the US inflation data is due on March 28.

The MACD chart for March 25 shows the MACD line in the positive zone, indicating a bullish trend. The signal line is also above zero, but lags behind the MACD. This indicates a persistent upward move with a moderate growth rate. The general trend remains positive.

The stochastic oscillator chart for March 25 shows that the blue line (%K) is at 20, indicating that the asset is oversold. This could signal the beginning of an upward move or a correction after declining. The overall trend is still unclear, but technical indicators hint at a potential improvement in the market.

Current recommendation:

Buy at the current price during the correction. Take profit – 0.633. Stop loss – 0.625.