18 April 2025

AUDCAD set to enter fifth wave of growth

On Friday, the AUDCAD currency pair is still consolidating, following a steady upward trend observed earlier in the week. Market activity remains restrained due to the pre-Easter period. However, the fundamental backdrop continues to favor further strengthening of the currency pair.

The Australian dollar received a boost from news regarding US President Donald Trump’s decision to exempt several technological goods from new reciprocal tariffs. This development is viewed positively by the markets, as these goods are primarily produced in China, a key trading partner for Australia and the main consumer of its commodity exports.

Additional support came from the minutes of the Reserve Bank of Australia‘s recent meeting. While the exact timing of interest rate changes has yet to be determined, the regulator has indicated the possibility of adjustments as early as May. This prospect is boosting interest in Australian assets, particularly in light of persistently moderate inflation.

In contrast, the Canadian dollar is exhibiting more restrained dynamics. The Bank of Canada maintained its interest rate at 2.75% this week, concluding a cycle of seven consecutive cuts. However, the regulator expressed concerns about the impact of US tariff policies on the economic outlook, which adds uncertainty to the national currency.

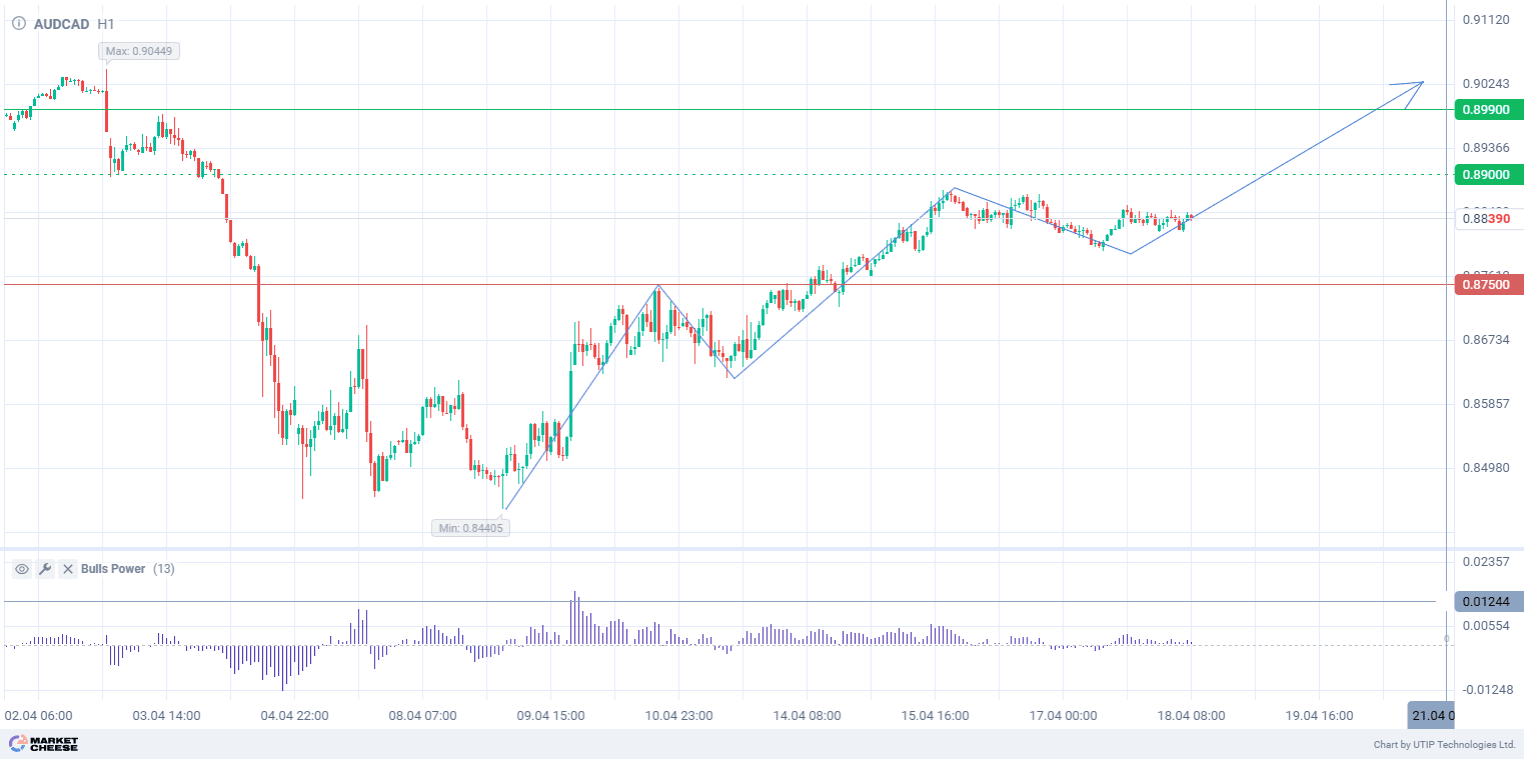

Technical analysis shows that the AUDCAD pair is forming an ascending pattern on the H1 timeframe. Wave analysis suggests that the current correction may be a part of the fourth wave, coinciding with the holiday period. A breakout above 0.8880 will confirm the end of the correction and signal the beginning of the fifth wave of growth.

The Bulls Power indicator (settings 13, open) remains above zero, indicating a prevailing buying momentum.

Short-term prospects for the AUDCAD currency pair suggest a buying opportunity with a target of 0.8990. Consider partial profit-taking around 0.8900, with a stop-loss set at 0.8750.

Given that the bullish scenario is short-term, the trading volume should not exceed 2% of the total balance to mitigate risks.