22 November 2024

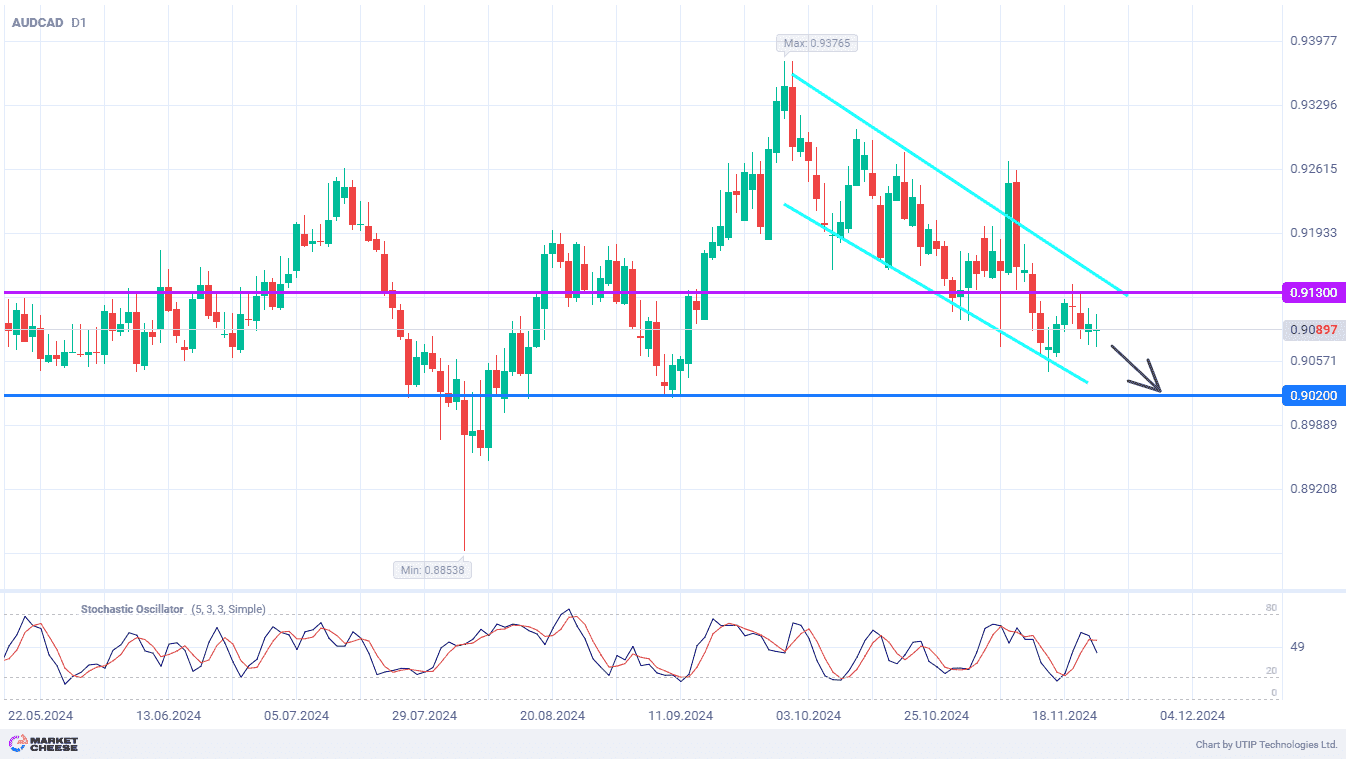

AUDCAD does not exit downward trend lines

The AUDCAD currency pair continues to move within the medium-term descending channel. The attempt to break out of this channel 2 weeks ago failed, and the quotes quickly returned to the renewal of the 2-month lows. Now, the bears will surely consider the September low near the 0.902 level as the main downside target. Under the corresponding news background, this level may be reached before the end of the fall.

Buyers of the Canadian dollar increased their activity for two main reasons. First, the inflation data for October turned out to be weaker than expected. The annual price growth rate broke a series of 4 consecutive slowdowns, and in monthly terms, the inflation rate reached its highest level since August last year. Secondly, the authorities announced a budget spending increase of 6.3 billion Canadian dollars (4.5 billion US dollars). According to Royce Mendes of Desjardins, under such circumstances, the Bank of Canada will not cut the rate by 0.5% again.

In the meantime, the Reserve Bank of Australia (RBA) nevertheless started to discuss the possibility of monetary policy easing. Such information became available after the release of the minutes of the November 5 meeting. Market participants started to actively adjust their forecasts on the first RBA key rate cut, changing the date from May to February 2025. One of the main uncertainty factors remains the possibility of introduction of 60% tariffs on imports of Chinese goods to the United States.

Goldman Sachs’ analysts have already rushed to cut their forecast for Australia’s economic growth for next year. In their opinion, GDP will increase not by 2%, but only by 1.8%. China is Australia’s main trading partner, so its economic difficulties will inevitably affect Australian exporters. Goldman Sachs believes that the RBA will need to reduce the cost of borrowing to at least 3.25% by November next year to avoid a sharp slowdown in GDP growth. As a result, the national currency will lose much of its support.

After an unsuccessful attempt to break above 0.913 from below, the Stochastic indicator again gives a sell signal for AUDCAD. The nearest target for opening short positions is 0.902.

Consider the following trading strategy:

Sell AUDCAD at the current price. Take profit – 0.902. Stop loss – 0.913.