14 November 2024

USDJPY growth is again becoming popular strategy in the currency market

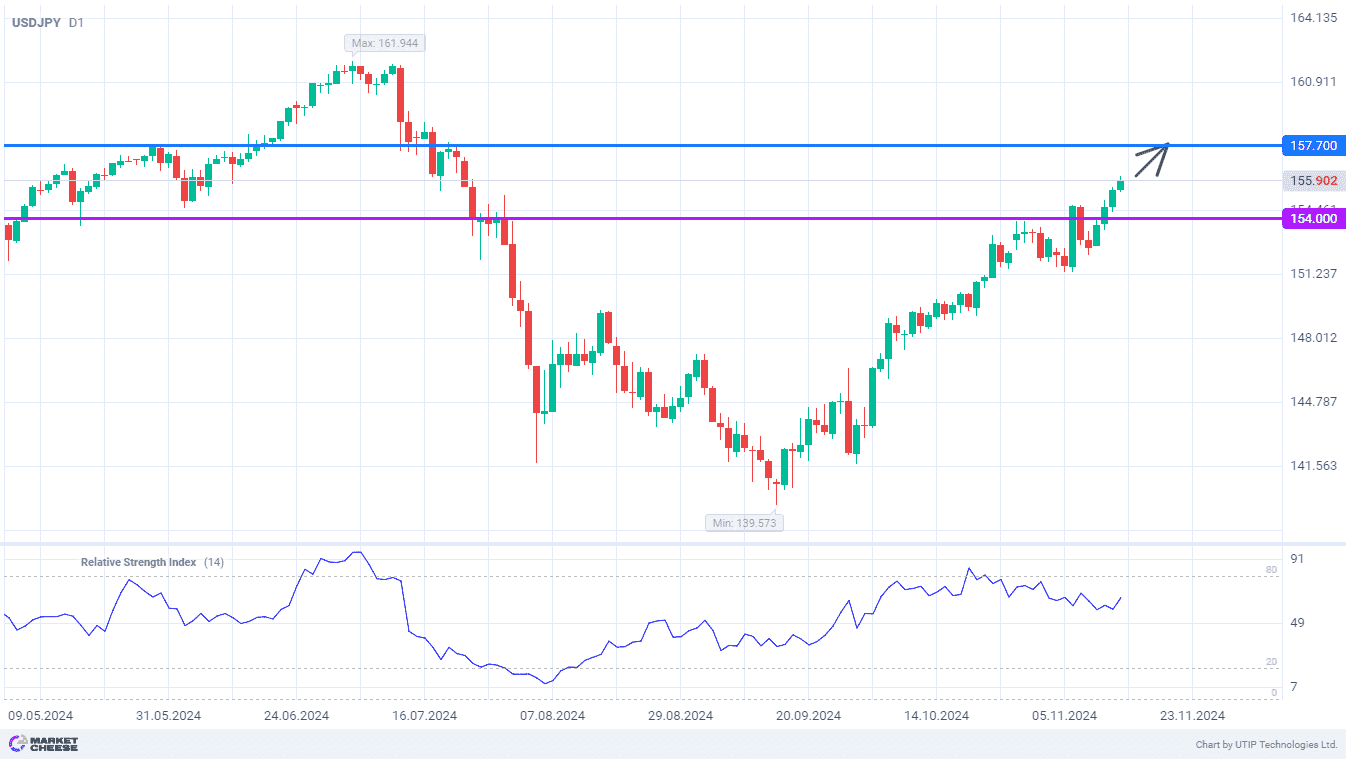

The USDJPY rates quickly regained the losses of late last week and continued to trade in the medium-term uptrend. Today the price for the first time since July tested the level of 156, and the next target of the buyers of the dollar against the yen may become the May high of 157.7. In the 3rd quarter, the bullish view on USDJPY’s prospects faded, but as the year-end approaches, this trading strategy is regaining its popularity.

Yesterday’s US inflation data for October did not prevent the dollar from strengthening. The Consumer Price Index (CPI) rose from 2.4% to 2.6%, meeting analysts’ expectations. With this background, the probability of a Fed rate cut at the meeting on December 18 exceeded 80%. However, the last meeting of the Fed officials this year is still more than a month away, so economic statistics may bring a lot of surprises. In particular, the new US policy remains a great source of uncertainty.

Meanwhile, market participants are once again set to sell the yen. According to the latest report from the US Commodity Futures Trading Commission, short positions on the Japanese currency have returned to the levels of August. Shoki Omori, chief strategist at Mizuho Securities, expects further increase in carry-trade transactions with yen as a funding currency. In his opinion, this trend will not even be prevented by a possible key rate hike by the Bank of Japan (BoJ) in December or January.

Bloomberg experts draw attention to the persistent reluctance of investors to keep assets denominated in yen. Despite the trade surplus of $57.5 billion in the 3rd quarter, the capital outflow from Japan reduces all the positive effects for the national currency. The low level of interest rates forces companies to sell yen immediately, favoring much more profitable assets in dollars. Despite the BoJ’s first steps to tighten monetary policy, their impact is still insignificant.

Technical indicators on the USDJPY daily chart suggest a further rise. The price’s next important limit will be 157.7.

Consider the following trading strategy:

Buy USDJPY at the current price. Take profit – 157.7. Stop loss – 154.