23 October 2024

Selling Brent crude at 65.0 if US inventories rise above 1.5 million barrels

The American Petroleum Institute today reported a modest increase in nationwide crude oil inventories. Experts estimated the increase at only 1.6 million barrels. Official government data from the Department of Energy will be released later today after the opening of the US session. In the current situation of extremely low demand and an oversupply of oil, any increase in inventories will benefit the bears. Last week’s reading showed a draw in inventories of 2.19 million barrels. Forecasts are for 0.8 million barrels, but given the reported high oil production in the US itself, the figure could be much higher.

In addition, diplomatic efforts are being made by various countries to normalize the situation in the Middle East, which may ease tensions and reduce the risk premium in the global oil market. Nevertheless, the threat of supply disruptions in the region, which accounts for about one-third of global production, is likely to persist in the medium term.

The world’s largest oil importer, China, has implemented a number of stimulus measures to combat slowing economic growth, potentially boosting energy demand, but the investment community has doubts about the effectiveness of these steps.

The crude oil market continues to be supported by a possible geopolitical premium, but should it start to decline, investors’ attention will shift entirely to the weak fundamentals, leading to a steady fall in oil prices, including Brent.

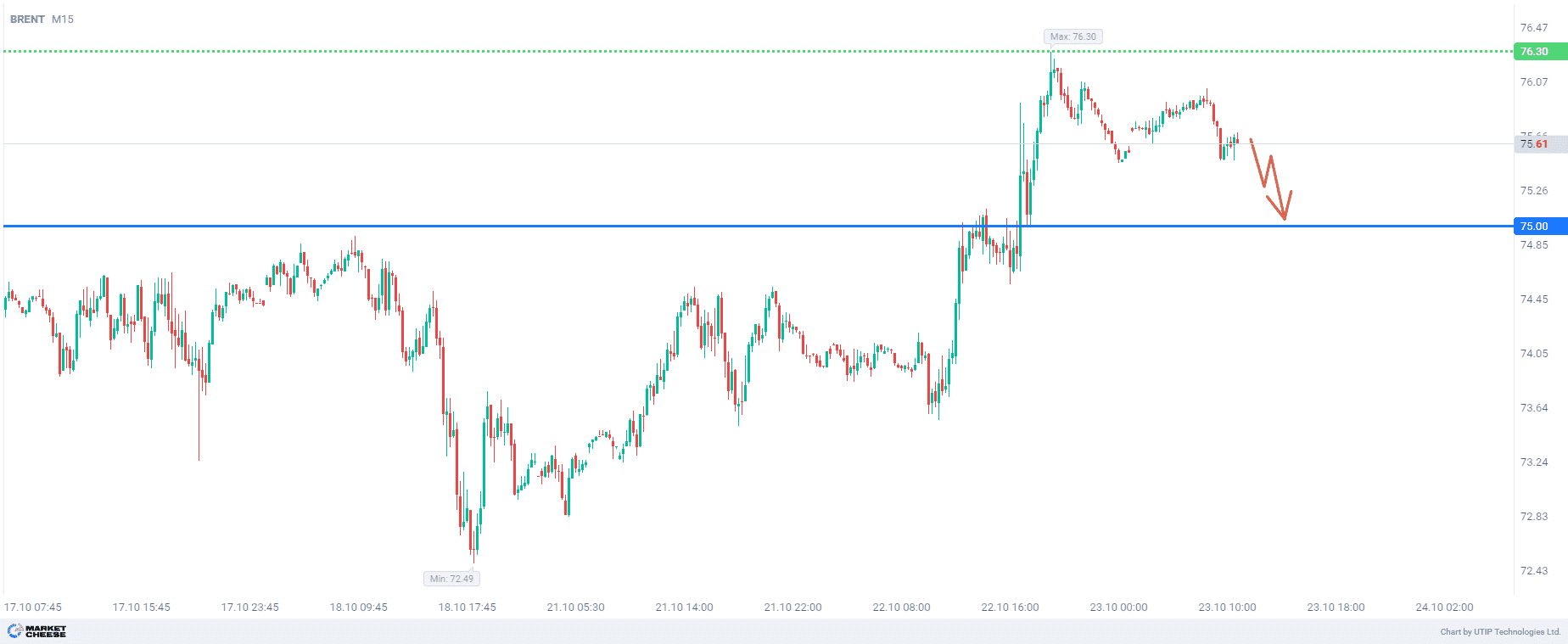

The overall recommendation is to sell Brent oil if the Energy Information Administration’s data on US crude inventories exceeds 1.5 million barrels.

Profit could be taken at 65.00. A stop loss could be set at 76.30.

The volume of the opened position should be set so that the value of a possible loss, defined with a protective stop order, does not exceed 2% of your deposit.