11 марта 2025

BTCUSD may fall to $65 000 as sellers get squeezed

BTCUSD fell more than 3% in early trading on Tuesday, but then made up for the losses. The decline was due to concerns about US stocks sell-off as they overshadowed President Donald Trump’s recent efforts to support the sector.

The first drop occurred after the crash of US technology shares. The Nasdaq 100 index, which is closely tied to this segment, plunged 3.8%, showing its worst result for the day since October 2022.

Investors were alarmed by Trump’s statement about a “little disturbance” Americans may face due to trade tensions.

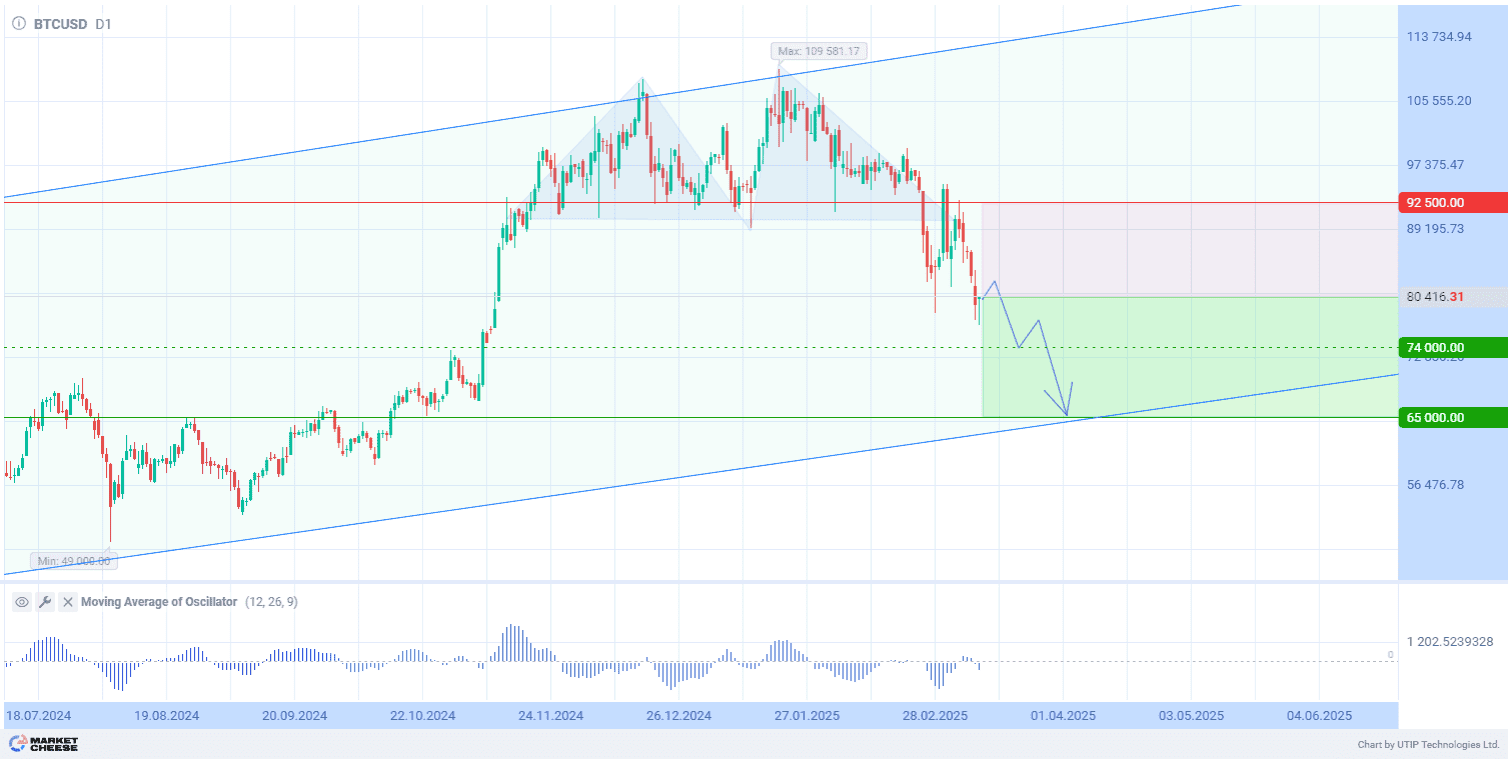

Technical analysis of BTCUSD on the weekly timeframe (W1) demonstrates a stable uptrend with several corrective phases. On the daily timeframe (D1), a “double top” pattern is working out its value after breaking through the support level of $92 000. At this stage, the price tends to trend support of the ascending channel of the senior timeframe.

The candlestick analysis for the last five days shows bearish dynamics with the formation of candles with long bodies going down, confirming the strengthening of the sellers’ pressure. Bullish candles until March 2 look like a small correction within the downward movement. There are no signs of reversal patterns of growth at the moment.

The Moving Average of Oscillator (12, 26, 9) is in the negative zone, confirming the bearish impulse. There are no signs of divergence, which strengthens the possibility of the downward movement continuation.

Bitcoin price remains within an uptrend, but signs of a correction are increasing.

Short-term prospects for BTCUSD suggest a price decline with the target 65 000.00. Part of the profit should be taken near the level of 74 000.00. A Stop-loss could be set at 92 500.00.

Since the bearish scenario is short-term, the trading volume should not exceed 2% of your total balance to reduce risks