18 апреля 2025

Brent crude poised to rebound to $69

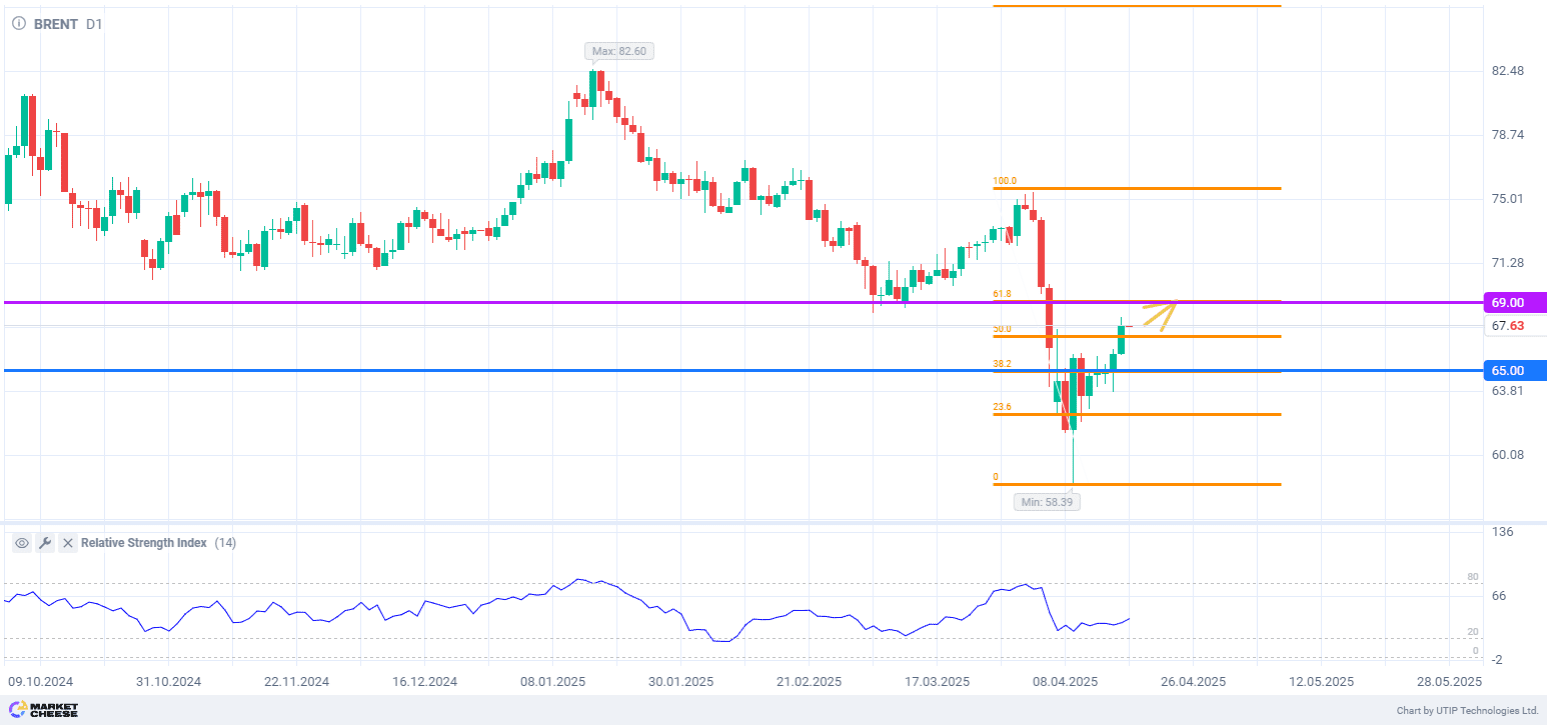

Brent oil prices surged by more than 4% over the past two days. The oil buyers regained more than half of their April losses, but there is another target ahead of them at the level of 69. The downward waves in September and March had stopped at this level, and now it may serve as resistance. Today the oil market is not trading because of Easter, but the bulls will surely try to test the 69 level next week.

The rebound was fueled by new sanctions imposed by the US authorities against Iran and the oil buyers from the country, including penalties against a Chinese refinery that purchased over $1 billion of Iranian crude annually. US Treasury Secretary Scott Bessent promised to put as much pressure as possible on Iranian oil supply chains, Bloomberg reports.

Meanwhile, OPEC+ eased market fears of a May production surge by maintaining restrictions on Iraq and Kazakhstan—both long-term quota violators. Iraq has already pledged to slash crude exports in May to compensate for overproduction. This reduces the risk of a surplus on the global oil market and supports price growth.

Reuters analysts focus on the damage caused to the American oil industry by the recent collapse of the prices. Local producers’ break-even level now stands at $60–71 per barrel, while the country’s prices are just near the lower limit of this range. Consequently, companies have little incentive to invest in new projects so they will put most of their efforts into existing fields. The International Energy Agency (IEA) in its April forecast reduced its estimate of oil production growth in the US for 2025 by 21%.

The RSI indicator has just exited the oversold zone, signaling potential upward momentum. The nearest benchmark for the Brent oil buyers will be 69.

Consider the following trading strategy:

Buy Brent crude in the range of 66.5-67.5. Take profit – 69. Stop loss – 65.